How to correctly take the promised payment on MTS. How to borrow from MTS: trust payment service How to give the promised payment to MTS

Expand all

How is the available amount of the promised payment calculated?

The more actively you communicate, the higher the amount of the promised payment:

See monthly expenses:

- in the “My MTS” application. To do this, go to the section “Invoice and payment” → “Expense control”

If you spend more than 500 rubles on communications. per month, you can set an additional promised payment if you have a valid one. The total amount of established payments should not exceed 1000 rubles.

What is the price

The fee for the “Promised Payment” service depends on the amount of the promised payment:

Each promised payment is paid separately. The debit is made upon the expiration of the payment in excess of the amount of the previously entered promised payment.

All prices include VAT.

How to take the promised payment

The service is available for activation with a balance of up to minus 300 rubles.

1 way. Dial the free command *111*123#.

Method 2. Activate the service in the My MTS application. To do this, go to the “Services” → “Available” → “Zero Opportunities” section.

3 way. Activate the service in your Personal Account.

4 way. Call toll free number 1113.

To automatically top up your account without commission using a bank card, use the "Autopayment" service.

Connection conditions

The service is available to subscribers of all tariff plans, except for the “Guest”, “MTS iPad”, “Basic”, “Your Country” and “Resort” tariff lines.

To activate the “Promised Payment” service, make sure that:

- You have been an MTS subscriber for more than 60 days.

- You have no debt on other personal accounts in MTS.

- You do not have the “On Full Trust” or “Credit” services activated.

- You do not have a valid promised payment. The exception is when an additional payment is available.

- You are not served using the credit payment method.

When using the “Promised Payment” service, the current tariff conditions apply, the payment method does not change.

The balance is displayed taking into account the amount of the established promised payment.

How to repay a promised payment

To repay the promised payment, top up your account with an amount equal to the amount of the promised payment and the cost of its connection.

When you top up your account using any of the methods, the previously established promised payment and service fee are automatically repaid:

- Partial. If the funds received into the account do not fully cover the amount of the promised payment and the cost of its connection.

- Complete. If the funds received into the account cover the amount of the promised payment and the cost of its connection.

It is important that your number is not blocked; within three days, replenish your account with an amount that is greater than the amount actually owed on the account, excluding the previously established payment.

Example Imagine that your balance is minus 200 rubles and you connected the promised payment of 500 rubles - 300 rubles appeared in your account. You spent 150 rubles, the account balance became 150 rubles. After three days, you will be charged 550 rubles (the amount of the promised payment and 50 rubles the cost of using it), and the balance on the account will be minus 400 rubles (i.e. 150 - 550 rubles).

Show questions and answers

Questions and answers

- Your balance is more than minus 300 rubles.

- You have activated the “On Full Trust” and “Credit” services.

- You already have Promised Payment enabled, unless an additional Promised Payment is available.

- You have debt on other personal accounts.

- You have been served by MTS for less than 2 months.

- You are connected to a tariff plan that does not provide this service.

Can I connect the promised payment through the operator? Why is the service no longer available in the contact center?

The terms of service in the Contact Center have changed: it is impossible to connect the “Promised Payment” through a Contact Center employee. You can activate the service yourself if your balance is at least -300 rubles and other conditions are met.

This is done to save time and for your convenience - so that you can easily manage your finances yourself, without waiting for an operator on the line.

Why is “Promised Payment” not available to me?

There may be several reasons:

If you cannot connect the “Promised payment”, use the services “Help out”, “Top up my account” and

The promised payment by MTS is, first of all, an opportunity to take money from a mobile operator if there is a negative balance (up to minus 300 rubles) on the subscriber’s mobile number with further return. If you do not have money in your account or are unable to replenish it, use this service.

Service: promised payment MTS

Currently, this is one of the most popular and popular options, which helps Mobile Telesystems clients stay in touch at any time of the day.

Now you can replenish the balance on your number yourself, even in areas remote from urban areas, where there are no terminals for depositing cash or there is no possibility of transferring money through the Internet bank.

The promised payment by MTS is an opportunity to borrow a certain amount for a while with the condition of mandatory repayment of the debt, because In case of non-payment, the number will be blocked without providing access to mobile communication services and the Internet.

Detailed information about the service can be provided by calling 111722, as well as by calling MTS TP number 0890. Use one of the following methods to receive payment:

- The first and easiest option is to dial the command *111*123# and press the “Call” button. The promised payment code can be dialed even while roaming. This operation can be performed on any phone or smartphone with a Mobile TeleSystems SIM card. The mobile assistant will send a notification to the phone screen; send in response the amount of the required payment. Within a few seconds you will receive an incoming SMS notification containing text about the successful completion of activation of the service on the number.

Performing a USSD request from your phone.

Performing a USSD request from your phone. - Control via . On a personal computer or laptop, open a browser and in a new tab enter the address of the official website - mts.ru. On the right, find and click on the “Login” button. Enter your phone number and your password from your personal account. After authorization, go to the “Number Management – Account Status” section. In the left navigation menu, click on the “Payment” item, where click on the second heading “Promised payment”. Here, indicate the amount (the site will tell you the maximum possible for your number) and the period. Next, check the correctness of the filled data and click on the “Set payment” button.

Helpful information: You can track the status of your application and see the number of activated options on the “Payment History” page.

Application . Download and install the mobile application on your smartphone or tablet in one of the official Google Play, Windows Market and Apple Stores. In order to be able to take the promised payment to MTS directly from your phone, just log in and click on “Menu” opposite the name, where you select the “Invoice and payment” item. Scroll down to the “Opportunities at zero” section, find “Promised payment” in the slider (first on the list) and click on it. In the new window, enter the amount and confirm with the “Connect” button. A system notification will appear on the screen almost immediately, click “OK” to enable the option. In a few minutes the funds will arrive in your account.

My MTS application.

My MTS application. - Direct call to short number 1113. When calling, listen carefully to the information about connection and cost. An automatic assistant will help you navigate when contacting.

- The fifth way to connect and get acquainted is the operator support service. To do this, call the short number 0890 and wait to be connected to a company specialist. Explain the essence of the issue and receive comprehensive information on the service. The employee can connect the promised payment to the number right during the call.

Many people are interested in whether it is possible to receive the promised payment on MTS with the Hype, Super or My Unlimited tariff plan. Yes, this service is available to all subscribers, except for the “Guest”, “Your Country” and “MTS iPad” tariffs.

How much does it cost and how to use it

First of all, it is worth noting the fact that the promised payment is provided on a paid basis. For its connection, the operator charges a commission, which directly depends on the requested amount. In total, the subscriber has three days to repay the debt after receiving the funds. It is important to return them on time, while avoiding blocking the number.

The commission amount for the promised payment is divided into the following stages:

- You can borrow up to 30 rubles for free. This applies to all MTS tariff plans.

- 7 rubles for receiving funds in the amount of 50-99 rubles.

- 10 rubles for transferring an amount of 100-199 rubles to an MTS number.

- 25 rubles per payment from 200 to 499 rubles.

- To get more than 500 rubles you will need to pay 50 rubles in commission.

Interesting fact: the size of the so-called loan directly depends on the cost of mobile communications, that is, the more you spend on servicing the number, the more money you can request.

Important conditions for connection

Before you start using this option, make sure that there are no debts on the number. It is imperative to comply with the operator’s requirement for a minimum active age of service on the network - 60 days, and must also have the “Full Trust/Credit” service in a deactivated state.

You can check everything through your personal account, go to the official MTS website and log in. Alternative options for updating information about connectivity are calling the operator and the My MTS application.

How to disable a promised payment on MTS

All funds taken from the mobile operator are clearly detailed. More detailed information about the number of payments, amounts and activation dates can be found in your personal account.

There is only one correct and sure way that can turn off the promised payment - you just need to repay the amount of the loan received along with the commission. The service is deactivated automatically; in case of non-repayment, the number will be blocked.

Standard options for disabling services:

- Go to the MTS LC section “Service Management” - “All connected services”. Click on the cross next to the name and disable the unnecessary option.

- In the " " application, select "Services". Next, using the menu, select what you want to connect or disconnect.

Important: If you have any difficulties and you were unable to resolve them with the Call Center operator, visit any of the MTS branches. The qualifications and level of knowledge of our employees will help you resolve any issue. It is advisable to have with you the passport on which the number was registered.

A negative balance on your phone can happen at any time, but you don’t always have funds available to quickly top up your account. There is a way out - borrow a small amount from a cellular company or, but first you need to find out how to borrow from MTS?

Promised payment

If the subscriber does not have enough money, then activating the “promised payment” from MTS is considered a simple and convenient option to take funds. The service allows you to borrow with an account balance of no more than minus 30 rubles. When connecting, the company will provide money up to 800 rubles for three days.

The amount of money depends on the number of days of cooperation with MTS and the cost of calls. If spending works out up to 300 rubles, then you can borrow 200 rubles. When spending from 301 to 500 rubles, MTS will provide 400 rubles. More than 501 rubles allow you to borrow 800 rubles.

Important! MTS trust payment is paid. The amount of the additional payment depends on the size of the debt and will be about 7-50 rubles.

The company provides the following options for borrowing:

- USDD request *111*123#call.

- Call number 1113. The auto-informer will tell you what to do next.

- On the official website of MTS. The service is located in the “Payment” tab.

"In full confidence"

The “In Full Trust” service will help you not to worry about losing access to calls if you don’t have money. Once you activate it, you will forget about the negative balance and unavailability of communication. The service allows you to go into the red by up to 300 rubles, which helps you make calls from your SIM card when you reach this limit.

The service is free. You can borrow from MTS without additional payments, which is considered a significant plus in relation to the “promised payment”. Another advantage is the possibility of increasing the limit by 50% of the monthly cost of calls six months after signing the contract. Enable the option and borrow money using the following methods:

- USDD command *111*32#call

- On the MTS website, open the “In Full Trust” tab, then “Limit Management”.

If after some time the amount of funds provided becomes too high and you need to borrow money in smaller quantities, then you can limit the upper threshold of available funds. If necessary, cancel the settings and return to the previous ones. To do this, send a USDD request from your phone *111*2136#call.

Comment! When the service is activated, the bill payment method will change to credit. Now you need to pay off the debt once a month, depending on the repayment amount. If payment deadlines are not met, the account will be suspended.

MTS does not provide a chance to borrow money to all subscribers. List of restrictions:

- payment without delay and in full;

- be an MTS user for more than three months;

- the amount of money deposited is at least 300 rubles for each month;

- there are no debts under MTS agreements;

- SIM cards with connected tariffs “Guest”, “MTS Connect”, “MTS iPad”, “Smile+”, “Basic”.

How to ask friends for money

Previously, MTS had the opportunity to send money as a loan to the required number using a USDD request. Now there are no options left and borrowing from friends or relatives by simply sending funds from one number to another will not work.

As a backup option, MTS helps you borrow funds by sending a message to one of the people in your contacts. This is not very convenient because you have to hope and wait for a person to be able to pay your bill through a bank card, terminal or mobile bank.

The service does not require payment or activation and works in all areas. You can send an SMS message to a subscriber of any mobile operator, for example, Megafon, Tele2 or Beeline. MTS allows you to borrow money from a friend in several ways:

- To pay a friend's cell phone bill, dial from your cell phone USDD request *116*number# call. Where the number is the mobile number of the person who will receive the refill request. You can dial numbers in any convenient way: 910ХХХХХХ, +7910ХХХХХХ, 8910ХХХХХХ.

- You can send a request with a specific amount using the command *116*number*amount# call. For example, *116*8910ХХХХХХ*100#, where the number is the telephone number of the subscriber who must pay the bill, and 100 is the amount of money to be replenished. The person will receive a message like: “Please top up my account in the amount of XXX.”

- Another option to borrow is to use a special mobile portal *111# call. After entering the USDD command, select the “Top up my account” field. If you don’t want to search for the required line, you can use a direct request - *111*7# call.

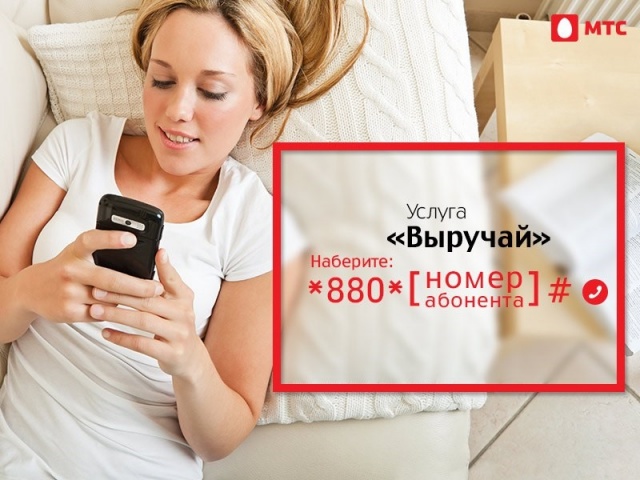

“Help out” service

MTS helps you make an urgent call and not have to wait for a friend to pay your cell phone bill. The “Help out” option will help you make a call at the expense of another client. The service will also help you send SMS. The service works with zero and negative balance.

By using “Vyruchai”, it will be possible to call a borrower to an MTS client’s phone at his expense completely free of charge. The option to send SMS is only available in the home region. There are two options to call a subscriber for his money:

- Make a call to the short number 0880. After waiting for the robot to answer, enter the number of the required person in 10-digit format, without using +7 or 8.

- Dial 0880 and immediately the subscriber's number. The phone is also dialed without a country code. For example, 0880910ХХХХХХ.

The person will receive an incoming call that needs to be answered. The voice of the autoinformer will inform you about the request to use his account to make a call to another subscriber. If the user does not pick up the phone or does not see the call, he will receive a message asking him to call the debt.

To send SMS at the user's expense, send a text indicating the mobile number to 5880 in the format 5880ХХХХХХХХХ, where X is the client number in 11-digit format. Any MTS client can accept this, except for users of the “Vyruchai” tariff plan.

This option can be used while abroad. If you suddenly run out of money on your balance, this will be very useful. To use the service while in a foreign country, dial the command: *880*number# call. The MTS subscriber number is dialed in 10-digit format without a country code.

With the help of banking and microfinance organizations

Recently, it was possible to borrow money by ordering a transfer to the balance of a mobile phone, but the service was not popular. The owners of the IFC have found a way - lending to a bank card, Qiwi wallet or Yandex.Money.

This method has become more widespread. Among the important aspects are affordable conditions and expedited processing of borrowed funds without a visit to the MTS sales office and microcredit companies.

Comment! The balance is paid through EPS (electronic payment systems) or bank cards without additional fees.

Conditions for receiving money

Regardless of the purpose for which the loan is planned, read the terms and conditions of the loan. To top up your mobile account or just for your own purposes.

Important! Money borrowed through the site does not require searching for guarantors and providing property as collateral, but the absence of special requirements does not allow one to count on large sums.

How much can an MTS subscriber be credited for:

- When submitting an application to a telecom operator - up to 30,000 rubles.

- In microfinance organizations - up to 30,000 rubles - 30 days. Up to 60,000 - 100,000 rubles for a loan of up to six months.

When submitting an application for a loan, it is important for the subscriber to read the agreement listed on the MTS website on the Internet. Most options allow you to charge from 7 to 50 rubles, except for the “In Full Trust” service.

If you send an application to a microfinance organization, you will have to pay for all days of using the debt funds. The amount of interest accrued depends on the organization, terms and days of the loan. Base interest rates:

- up to a month - 1-2.2% per day;

- more than a month - 0.2-0.8% per day.

Important! MFOs may apply additional fees to basic payments. Be sure to check this point when applying for a loan.

Organizations providing loans impose insurance policies, but it is possible to refuse them. The money provided by the IFC can be used not only to pay the cell phone balance, but also for any necessary purposes.

Requirements for borrowers

There are no special conditions for borrowers. There are a few small notes that must be observed. In order to borrow funds from MTS, it is enough to use the number for more than 100 days, have no debts under all contracts and not activate the “On full confidence” option, then microloans have slightly different conditions:

- Citizens can borrow money upon reaching the age of 18. Such rules are established by Russian legislation, but many organizations require 20-23 years of age to reduce the risk of non-return.

- Have permanent registration.

- Having a permanent job to be able to pay debt and interest.

When applying for a loan using the websites of organizations, the region of residence and registration does not matter. IFCs issue loans in all regions. Having an official job is not required; it is important that the income helps to fully pay off the debt. This adds the opportunity for those working from home and retirees to take money.

Offers from microfinance organizations

Many organizations provide loans to MTS users. The rules and methods of receipt differ everywhere in terms of accrued interest and some other parameters.

It is not always possible to find suitable conditions for obtaining a loan on your own. There are services on the Internet that select ideal conditions for obtaining a loan.

Important! When taking into account a possible overpayment on a loan, you should take into account additional payments that affect the amount of money that can be borrowed.

There are constantly a large number of fraud cases related to online loans. Passport data can easily be used by third parties, and money can disappear from a bank account.

In order to prevent such situations, it is important to use only reliable companies that have the necessary permits.

A few more ways

MTS users have the opportunity to borrow using simple methods. Receiving a loan takes from a few seconds to an hour. If you try to take larger amounts, you will have to wait up to 24 hours, due to the fact that the IFC will check the client’s information in more detail.

Loan options available today:

- MFK - using the network to a bank card or wallet on the network.

- Borrowed money from a mobile operator.

- Options provided by MTS.

- Take a loan from MTS Bank.

Through the Internet

You can simply go to the website of a microfinance organization and borrow money. The transfer of money will take place via the network. The process of drawing up a loan agreement:

- go through the registration procedure on the selected MFO website and fill out the form;

- choose convenient conditions and rules;

- wait for the decision on the questionnaire;

- sign an electronic contract and borrow funds using an affordable option.

When filling out the application, you must enter your cell phone number and personal information. A special code will be sent to the phone, and then access to the client’s page will appear, where a form will be filled out to confirm the contract.

In addition to your passport, you are required to fill out information about your place of employment or other ways of earning income and contact numbers. It is important not to forget to indicate the method of loan delivery and the required loan amount.

The decision comes within an hour upon the first application, further ones are confirmed much faster. For comparison, it is worth looking at the conditions of the largest microfinance organizations:

- Zaimer. A robotic system is responsible for issuing funds on loan. Rate 1-2.2% up to 30 days. Amount - up to 30,000 rubles.

- One Click Money. They lend money to almost every person. 2-2.2% up to 21 days. Amount up to 25,000 rubles.

- SMSFinance. Reduce loan interest if there are no delays. 1.6% up to 30 days. Amount up to 30,000 rubles.

At MTS Bank

MTS subscribers are offered special, favorable conditions when applying for a loan from a bank. Possible amount could be up to 1 million rubles at 12.9-25.9% per annum.

Receipt of money usually lasts for 3-5 years. There is an option for early repayment of the loan in full or in part. The bank will recalculate the commission, and the overpayment will become noticeably less. To submit an application you must:

- go through the procedure of filling out the questionnaire and wait for a preliminary decision;

- Take the necessary papers with you and bring them to the MTS office;

- Receive final confirmation and sign the contract.

Receiving money takes about 3-7 days, but it is possible to get more money than when applying to an MFO, and the overpayment will be significantly lower.

To a bank card

You can withdraw funds to a bank card using all companies that provide loans remotely. Applying for a loan is no different from receiving money via an electronic wallet. When receiving funds on a bank card, clients can spend the received loan not only to pay their cell phone bill, but also for personal purposes. For example, popular services offer the following conditions:

- Lime. The system is fully automated. Interest rate 0.4-2.2% up to 168 days. Amount up to 100,000 rubles.

- Vivus. For those who pay the loan on time, interest reduction. Rate - 1.9% up to 30 days. Loan up to 30,000 rubles.

- e-Loan. The initial application allows you to take up to 15,000 rubles. Commission - 1.5-2.2%. Amount up to 30,000 rubles.

Basic conditions of registration

Getting any loan is a very important step. The client is obliged to calculate his options in advance and be completely confident in the repayment of the loan.

Important! Failure to repay borrowed funds significantly increases the amount of debt and spoils your credit history. Obtaining new loans will become significantly more difficult.

Read the contract you sign carefully. Find out in advance the repayment deadlines and payment procedures to avoid delays that lead to damage to your credit history.

Agreement

The document that the client signs is called an agreement. It serves as a direct communication between the company and the client. It specifies the terms and conditions of loan repayment. Be sure to look at the following points:

- amount received;

- loan term;

- interest rate;

- amount of commission and additional payments;

- money delivery options;

- debt repayment procedure.

Applying for a loan and receiving funds imposes an obligation on the borrower to repay the debt, regardless of the method of signing the agreement. Both the signature on paper and in electronic form will have legal force.

Required documents

In order to take money onto the MTS balance, the operator does not need to provide documents. The passport data was entered when signing an agreement on the provision of communication services when purchasing a SIM card. For a small amount this is quite enough.

Comment! When applying for a loan from an MFO, you must provide your passport information to verify the information entered. A certificate of receipt of the required income is not required.

Sometimes organizations require you to upload the following documents:

- insurance certificate;

- driver license;

- certificate from the tax service;

- international passport;

- military ID.

When applying for a loan from MTS Bank, you must provide a certificate of income in 2NDFL format. Without this paper, you will not be able to borrow money.

Application

When submitting an application to receive funds for your cell phone balance, you should simply use your own phone. Registration takes place in a few seconds automatically, with confirmation via SMS message. If you fill out a form in order to borrow money through a microfinance organization, the procedure will be slightly different:

- register on the company website;

- enter personal data;

- wait for a loan decision;

- sign an agreement;

- Taking the money you receive is a convenient option.

It is possible to take out a loan remotely, via the network. To sign the contract, you need to enter a special code that is sent to the recipient’s phone.

Comment! MTS Bank provides a chance to fill out a loan application form through the website, but to receive confirmation you must provide the entire package of documents to the bank office.

How to pay off a debt

To pay for a debt taken out via telephone, you should top up your cell phone balance. MTS will write off the required amount and money for additional payments.

Microfinance organizations indicate in the contract the dates for the payment schedule and the amounts to be paid, which are a mandatory part of the signed agreement. There are several options to pay for your loan:

- send money to a bank account;

- pay at the appropriate terminals;

- deposit cash using mobile phone stores or payment systems;

- use a bank card or electronic services.

Advantages and disadvantages

The main disadvantage of loans from microfinance organizations is considered to be high interest rates on the loan. In banks they are much lower. The additional fee for the “Promised Payment” option is also high, given its short validity period. The advantages include:

- filling out a form via the website;

- fast loan approval;

- practically no documents are required;

- possible bad credit history;

- a chance to take out a loan with minimal risk of being rejected;

- many payment methods.

Each person is free to independently decide whether to borrow from a microfinance organization or not, but small loans from the MTS company help you always stay in touch or call the right person, regardless of whether there is money in your account.

A request for a loan from MTS is completed in a few clicks from a mobile phone. Small commissions are allowed to anyone who wants to borrow, repayment is made by replenishing the balance.

Using the above methods helps you quickly and easily reach the desired person, top up your account or take money for personal use. The possibility of obtaining a loan with a negative balance or a blocked number is considered especially convenient.

Today, every mobile operator provides the subscriber with the opportunity to borrow funds, and MTS is included in the line of these operators. Such services have been available for a long time. Today, cellular communications are available to almost all people, and even in the most remote wilderness you can get several sticks on the connection indicator.

Many people have found themselves in a situation where they need to make a very urgent call, there are no funds in their account, and there is no opportunity to top up their account in the near future. It is for such situations that a service has been created, according to which you can borrow funds from a cellular operator. MTS provides trust payments for various amounts and terms, but in order to borrow various amounts from a given operator, a certain compliance with the terms of use is necessary; such conditions can be found extremely rarely.

How to borrow from 10 to 700 rubles on MTS?

The most common option is the MTS Promised Payment service, it is available to all network users, but for those who have just connected, the maximum loan amount is 50 rubles. But then the limit can increase and reach as much as 800 rubles per week. However, the limit grows not depending on how much time a person uses the connection, but depending on the monthly communication costs.

In order to be able to take out a loan in the amount of 100, 200 rubles, communication costs in the previous month must be at least 300 rubles. An amount of 300-400 rubles can only be obtained at a cost of 301-500 rubles. If a network user spends more than 501 rubles per month, then he can take out a loan ranging from 500 to 800 rubles. Regardless of your monthly expenses, you can take out the amount of 50 rubles at any time.

But there are certain restrictions on using a loan, because until the loan funds are repaid, it seems impossible to take out a loan again. But in the case when the user’s monthly expenses are equal to or exceed 500 rubles, he can take out a loan per week, the maximum amount of which is 800 rubles. There are a number of MTS services that are not compatible with the “Promised Payment”, for example, services such as “In full confidence” and “Credit” include a negative balance limit; under these conditions there is no need for a loan.

In order to borrow a certain amount, you need to dial *111*123# , then enter the required amount and make a call. For example, if you need to take out a loan of 50 rubles, then you need to dial *111*123#50 and call. After this, you will receive a report confirming that the MTS Promised Payment service has been activated.

You can also use the Internet assistant or dial the number 1113 . If you need to take less than 20 rubles, then you can use the service for free, if more than 20 rubles, then a 5 ruble subscription fee will be charged from your account. The MTS trust payment is provided for a week and, based on this, during this period the subscriber must deposit this amount into his account.

How to borrow on MTS if the balance is negative?

“Promised payment MTS” will come to the rescue even when the balance is below zero. In this case, you need to top up your account immediately after connecting to the service. However, in this situation there are certain limitations. Borrowing funds with a negative balance is permissible only if the negative balance is no more than 30 rubles. If there is -31 rubles in the account, then you will no longer be able to take out a loan.

To be able to call with a negative balance, there is a “Credit” service. According to its terms, you can communicate at a minus of up to 300 rubles. In certain MTS tariffs, the “Credit” service is available by default. It is very important to be aware at this moment. After all, if the amount exceeds the limit and the bill is not paid on time, the number may be blocked.

In order to use the service, you must send SMS with a number 1 to the number 2828 , and to disconnect, send 0 to this number. If you encounter problems connecting, you can dial *111*30# and onwards 1 to connect to the same number 2 to disable the service. If you use the “Credit” service, then it is impossible to activate the “Promised Payment” service. Access to communication with a negative balance can also be obtained using the “On Full Trust” tariff.

How to take an MTS trust payment from 50 to 3,000 rubles or more?

The maximum debt limit in MTS is 800 rubles, but there is a tariff with a default credit limit. That is, you will not have the need to use the above services. You can simply communicate up to a certain negative amount, which can be 3000 rubles, this level can even be exceeded. To meet such needs, there is a service “In Full Trust”.

This service has a default limit of 300 rubles. However, after six months, with timely monthly payments, this limit increases to an amount that is 50% of the monthly payments. That is, if you spend 6,000 rubles a month on using MTS services, then your limit is 3,000 rubles. But for this you need to be a bona fide MTS subscriber for more than 3 months. When connected, the balance must be positive.

The limit is increased in the case of timely payment of bills, constantly increasing costs for MTS services; the limit must be exceeded by at least 50 rubles. In case of late payment of the bill, the maximum limit remains the same (RUR 300).

To activate the service you need to dial *111*32# and call, as well as using the Internet assistant. “On full confidence” is an excellent service for those who have high communication costs and sometimes don’t even have enough time to top up their account.

Reading time: 2 min.

As always, the money on your phone runs out unexpectedly. But what if you need to get through urgently, but the nearest ATM is far away? It is not difficult to solve this problem: you can borrow money from MTS, that is, use the “Promised Payment” service.

The operator offers several ways to receive advance payments on your phone. You can use the “Top up my account” or “On full confidence” services. But taking a deferred payment from the operator itself is much easier.

How to take the “Promised Payment” on MTS?

To receive the promised payment on MTS, just use a simple combination of numbers on your phone or activate this service on the operator’s website. The trust payment is given for 3 days. During this time you will need to top up your account again, otherwise your further calls will not be possible.

There are several ways to activate the option:

There are several ways to activate the option:

- There is a simple USSD command to borrow the promised payment - dial the combination *111*123# and press .

- Call 1113 - you will be taken to a voice menu where, following the prompts, you can also take an advance on MTS.

You can also find out about connected and outstanding trust payments in several ways:

- Send USSD request: *111*1230#

- Call the number: 11131

Of course, for the same operations you can use the “Internet Assistant” service on the MTS website: Go to your personal account, go to the section "Payment" → "Promised payment".

Conditions and cost

The minimum advance amount is 50 rubles. The maximum credit depends entirely on how often and how much you top up your phone each month. You can find out the amount of the trust payment that can be allocated to you in the operator’s Contact Center by calling 0890.

When replenishing your balance, you must take into account that, before the promised payment is written off, your account will reflect not only the amount of the contribution, but also the advance you received. Only subscribers whose communication costs are significant (with a monthly fee of over 500 rubles) can take the promised payment again without repaying the debt.

There is a small fee for this service:

- up to 30 rubles – no commission;

- from 31 to 99 rubles – commission 7 rubles;

- if you took an advance from 100 to 199 rubles, it will be 10 rubles;

- if the debt is 200-499 rubles, 25 rubles will be deducted from you;

- upon receipt of the promised payment over 500 rubles, the commission is 50 rubles.

Any subscriber can receive the promised payment on MTS. The exception is iPad users and subscribers of the “Guest”, “Basic 092013” or “Your Country” tariffs. This is due to the fact that payment for them is charged monthly, and taking a small advance simply does not make sense. In addition, they already have a negative balance limit.

For persons who have outstanding debts for using the service, the option will be available again upon full repayment of the advance taken. Customers who purchased an MTS card less than 2 months ago can use it only with a positive balance.